Vat and corporate tax are two different types of taxes and people usually stuck and ask What is the Difference Between VAT and Corporate Tax?

The UAE, serving as a prominent business hub, has separate rules and regulations that companies must operate. Business owners must follow the local laws, particularly regarding taxes, as their companies operate in the UAE. Corporate tax and VAT are the key taxes that demand a businessman’s attention. This blog focuses on clarifying the definitions and distinctions between these taxes, providing essential insights for individuals establishing and managing businesses in the UAE.

What Is Corporate Tax (CT)?

Corporate tax is a profit-oriented tax imposed on the net income or profits of an organization. The standard corporate tax rate in the UAE is 9%, but businesses with profits not exceeding AED 375,000 are exempt from this tax. Corporate tax in the UAE is based on a company’s income and does not directly impact consumers.

The tax is calculated after determining a company’s taxable income. Corporate tax is computed using the net income, factoring in business-related costs and deductions. This tax places a significant emphasis on enterprises, influencing their overall financial performance and profitability.

What Is the VAT In UAE?

VAT, a consumption tax, is imposed on most goods and services purchased by consumers. The VAT rate in the UAE stands at 5%, with certain products and services either excluded or subject to a 0% rate. Tourists have the opportunity to receive an 85% refund on the VAT paid for products purchased in the UAE. Given that consumers bear the brunt of these taxes, VAT predominantly affects them.

How to Calculate Corporate Tax in the UAE?

Here are guidelines to help you understand how corporate tax is calculated in the UAE. It is important to have a clear understanding before filing your corporate tax return.

The corporate tax is set at 9% for taxable income exceeding AED 375,000. If a corporation earns below this amount, they will have a 0% corporate tax rate. Let us calculate this with an example:

For taxable income between AED 0 and AED 375,000, the corporate tax rate is 0%, resulting in AED 0 in tax.

For the portion of taxable income exceeding AED 375,000 (e.g., AED 400,000 – AED 375,000 = AED 25,000), the tax rate is 9%, amounting to AED 2,250.

So, the total UAE corporate tax liability for the year is calculated as AED 0 + AED 2,250, which equals AED 2,250.

It is important to note that any foreign taxes paid on the relevant income will reduce the final amount of UAE corporate tax payable.

What is the difference between corporate tax and value-added tax?

Here are guidelines to help you understand how corporate tax is calculated in the UAE. It is important to have a clear understanding before filing your corporate tax return.

The corporate tax is set at 9% for taxable income exceeding AED 375,000. If a corporation earns below this amount, they will have a 0% corporate tax rate. Let us calculate this with an example:

For taxable income between AED 0 and AED 375,000, the corporate tax rate is 0%, resulting in AED 0 in tax.

For the portion of taxable income exceeding AED 375,000 (e.g., AED 400,000 – AED 375,000 = AED 25,000), the tax rate is 9%, amounting to AED 2,250.

So, the total UAE corporate tax liability for the year is calculated as AED 0 + AED 2,250, which equals AED 2,250.

It is important to note that any foreign taxes paid on the relevant income will reduce the final amount of UAE corporate tax payable.

Following is the major difference between VAT and Corporate Tax in UAE

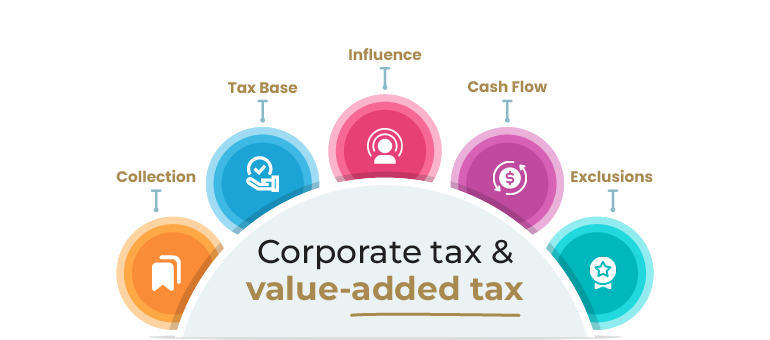

| Aspect | VAT | Corporate Tax |

| Collection | Businesses gather VAT from customers and remit it to the government. | Corporations directly pay corporate tax based on their income. |

| Tax Base | VAT is applied to revenue. | Corporate tax is imposed on profits. |

| Influence | VAT primarily impacts consumers by increasing the prices of goods and services. | In contrast, corporate tax affects the profitability of companies in the UAE. |

| Cash Flow | VAT businesses must collect and return the tax. | Corporate tax has no immediate impact on cash flow. |

| Exclusions | VAT includes exclusions and zero-rated categories. | Corporate tax is determined based on income criteria. |

Importance of Implementing Corporate Tax In The UAE

Following are the Importance of Implementing Corporate Tax In The UAE:

- Introduction of Corporate Tax aligns with UAE strategic objectives for development and transformation.

- A competitive Corporate Tax regime, following international standards, contributes to the UAE position as a leading hub for business and investment.

- The UAE extensive network of double tax treaties further enhances its attractiveness for global economic activities.

- The Corporate Tax regime draws from global best practices and incorporates internationally recognized principles.

- Leveraging its status as an international business hub, the UAE Corporate Tax system is designed to be clear and easily understood.

- The government’s clarity ensures transparency in its implications and the development of confidence among businesses and investors.

Who Needs to Register for Corporate Tax In UAE?

There are two types of groups in Corporate Tax who need to register for Corporate Tax in UAE

Qualifying Group:

Two or more companies/individuals can form a Qualifying Group if the owner of each company has direct or indirect ownership of at least 75% of all companies. No formal approval from the FTA is needed to create a Qualifying Group.

The transfer of assets and liabilities within Qualifying Groups will not result in any gain or loss for tax purposes. Each member calculates its profit or loss and complies with tax regulations.

Tax Group:

Creating a Tax Group requires two or more groups of companies or individuals, with each shareholder owning at least 95% of voting rights. Approval from the FTA Authorities is necessary to form a Tax Group.

The Tax Group is treated as a single taxable entity. Its taxable income is the sum of the net income/loss of all group members, and the group pays Corporate Tax on the entire group’s net income.

Do Freelancers Have To Pay Corporate Tax In the UAE?

All business operations conducted in the UAE under a trade license or permit fall within the sphere of UAE Corporate Tax. Licensed freelancers, earning taxable income exceeding AED 375,000, are obligated to obey with UAE laws by paying the relevant corporate tax.

It is essential for businesses and freelancers to stay informed about their tax obligations, ensuring loyalty to the UAE Corporate Tax regulations to avoid any legal repercussions. Timely and accurate tax compliance contributes to the overall economic stability and growth of the UAE.

In Short…

The UAE implementation of VAT and Corporate Tax reflects a strategic move towards economic modification and global fiscal standards. VAT impacts consumers, covering a broad spectrum of goods and services, while Corporate Tax, set at 9%, focuses on businesses’ profits. These measures contribute to the UAE financial stability, reducing reliance on oil revenues and developing sustainable economic development.

The tax framework ensures a balance between individual and corporate responsibilities, promoting fiscal stability and strengthening the UAE position as a dynamic and globally competitive business destination.

FAQs:

Following are the faq’s:

The UAE is implementing VAT to diversify revenue sources, reduce dependence on oil, and contribute to sustainable economic development.

VAT is generally applied to the majority of goods and services, but certain items may be exempt or subject to a 0% rate.

VAT is a consumption tax paid by consumers, while corporate tax is levied on a company’s profits, affecting the business rather than consumers.

Corporate tax is introduced to enhance fiscal stability, align with global taxation standards, and contribute to the UAE economic resilience.

The standard corporate tax rate in the UAE is 9%, but businesses with profits not exceeding AED 375,000 are exempt.

Companies and businesses in the UAE with profits exceeding AED 375,000 are required to pay corporate tax.

While there is no personal income tax, businesses may be subject to VAT. And also corporate tax, depending on their activities and profitability.

Let RFZ Accounting handle your VAT and corporate tax!

If you are having any trouble or queries about VAT and corporate tax, RFZ Accounting is the company that can assist you in handling the tax.

At RFZ Accounting, we offer personalized help to people who are looking for guidance in the UAE VAT and corporate tax. We can assist with everything from managing your accounts and finances and making sure you follow the rules. Our experienced team, will give you trustworthy advice at every step of your business journey in the UAE.

For a free consultation, contact us at +97142657081.You can also send us a WhatsApp message at +971 542897650 or email your questions to info@rfzaccounting.ae.

We are here to assist you!